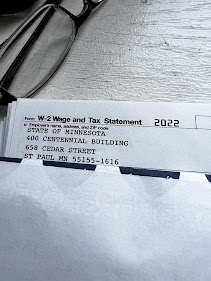

Well it is that time of year again when I have to start making the preparations to get our taxes done. You know that time of year that you pray you have kept out enough deductions so that Uncle Sam won’t come a calling and collect money. That day of the year when you hope you can disappoint the government by actually getting something back on the return.

For the past few years we have had a person do our taxes just for my peace of mind. For many years I did our taxes and itemized every little thing I could remember. I would fill in all the forms and millions of lines, add all the W-2’s and stick it all in an envelope or file it online. And then wait…hoping and praying that I filled everything in to the IRS’s satisfaction, hope all calculations were accurate and then pray really hard that I wouldn’t get audited. Because if that happened, well let’s just say I doubt I could argue with the IRS lying in the fetal position sucking my thumb. Because that is the vision I have of me doing taxes and being audited.

A few decades ago when we just had to deal with each of our W-2’s, our mortgage interest, and a few other deductions I did our taxes. One year we had replaced some windows and I put in for the energy credit the government was allowing.

I read all the instructions on the form from the IRS and plugged in all the numbers and did the calculations. It showed we would receive about $90 extra back on the refund. So I finished all the forms and put 2 stamps on the envelope and sent it off to Provo Utah which is where Minnesota was to send taxes to the IRS back then. Remember this is decades ago with no home internet at all. I am not even sure faxing ability was around yet. It was prehistoric times.

Anyway, I sent the taxes in and then the wait for the refund check would begin. Imagine my surprise when about 3 weeks later I got a letter from the IRS. Thinking it was our refund, I ripped it open, only to find a letter and some blank forms. The letter explained that we were receiving a random audit on our taxes for the year! I found my heart rate picking up pounding in my ears, and I felt like I may puke my guts out. All the TV shows I had ever seen with people getting audited by the IRS were flashing back to me. You know the ones where big rich mob syndicates were under investigation and sitting with their lawyer going over the books.

After calming down a bit, I went through the forms and paperwork. They were questioning our energy credits and felt we owed them $86.12. Yes 20 plus years later I can remember the amount they wanted. The amount that probably would put me in jail if I didn’t pay. I sat down and filled out the forms they requested and made out a check to the IRS for $86.12. I just wasn’t going to fight it, I figured they were the IRS and I could never beat them. Besides, I liked life on the outside better than I think I would like jail.

I once again mailed out the forms to the IRS in Utah and waited. And then waited some more. After a month, I finally received a letter from the IRS. I figured it was more paperwork to keep me out of jail. But when I opened it there was our refund check and another check for $113.54. The extra check was the energy credit refund.Someone in Utah had done the math once again and looked at the return and decided my calculations had been right after all. The extra $27.42 was interest in the $86.12 I had paid them from the audit. Imagine my surprise to think the IRS actually was honest and returned my money to me.

After that year of doing our taxes, I hated doing them even more than I ever did before. But I kept doing them until the IRA and 401 accounts were set up. And we refinanced the house to lower interest rates. It became a massive amount of extra forms, and calculations. I was about 95% sure I was doing them wrong and we were going to get audited again. We, mostly me, decided it was time to have someone who knew what they were doing handle it.

So a call was made to our financial planner guy who had a tax person on their staff. About a month before tax season we were sent a packet of information they would need to do our taxes. All the forms we would get in the mail, all of our W-2’s, any things we may have paid sales tax on, and so on. Basically all the things I had to gather in the past for taxes, I needed to gather for the tax person. And then drive it over to the office in the next town over which was 20 miles one way.

So I spent an entire day gathering all the info and forms that arrived in the mail and drove them over to the tax guy. As I was driving over, I started asking myself, “why the heck am I doing this, putting all the info together just so the tax person can plug the numbers into the 1040 forms and the others? And then get paid his cut.

But then I remembered reading through all the forms and the instruction book they sent from the IRS. And all the new rules and forms. And the amount of time it consumed actually completing the forms. And the chance of getting audited. While I am honest in our tax doings, I sure don’t know much about them. As I drove over, my mind relaxed a bit and I was able to turn in all the info and walk away. Within a week there would be the refund deposited online to our account.

This week I have started the hunting and gathering of all the needed tax info to drive over to our tax guy. And it never seems to get any easier on my end. It has been about 5 years since we started having someone else do our taxes. And I have to say each year I still question if it is worth having someone else do them when I am doing all the work gathering the stuff. And for us, I have come to the conclusion it is my way of treating myself to not having to do the forms and then pray I did it correctly, or at least well enough to keep me out of jail. Yeah, it is always a good thing when uncle Sam doesn’t want me.

For sure! Just driving my pile over today! ughhhhhh!

ReplyDeleteGood luck to you!

ReplyDelete